Our Investment Philosophy

We are committed to maintaining the highest standards of integrity and professionalism in our relationship with you. We place your interests above all else and strive to help you make sound financial decisions and stay on a solid financial path. We endeavor to know and understand your financial situation in detail and provide you with only the highest quality services and information in order to help you reach your goals and provide for a secure retirement.

We will provide you with frequent communication and on-going financial planning meetings to help keep you on a solid financial path. Our purpose is to work closely with you to help fulfill your financial dreams and create a strong financial future.

The majority of our clients are high net worth individuals and families including many aerospace retirees or active employees within five years of retirement. We take a safety-first approach to investing by designing customized and generally more conservative investment portfolios for our clients. However, portfolios can be customized to individual financial objectives and risk tolerances.

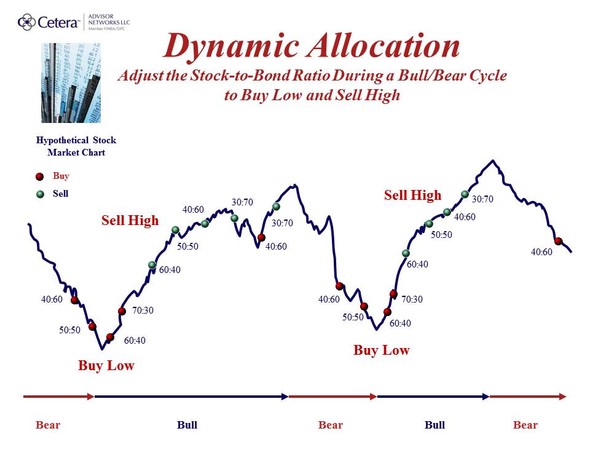

Dynamic Allocation

We seek to provide retirement income with lower risk and volatility using an investment strategy known as Dynamic Allocation. This strategy provides a disciplined approach to portfolio management by buying low and selling high during a bull/bear cycle. A bull/bear cycle refers to the repeating pattern that the stock market undergoes whereby the market rises for generally several years (a bull market) followed by a downturn of 20% or more (a bear market).

Using Dynamic Allocation we seek to buy stock investments in increments during a bear market while the market is low. Then, during a bull market when the stock market is rising we incrementally sell to lock in the gains and progressively shift to more conservative portfolios over time. While no investment strategy can guarantee positive results and past performance is not a guarantee of future results, we believe that Dynamic Allocation may provide a lower risk approach to investment management.

Here are some more details. The main feature of Dynamic Allocation is an adjustment of the stock-to-bond ratio of a portfolio during a bull-bear cycle. The stock-to-bond ratio simply refers to the fraction of stock investments relative to the fraction of bond investments that a portfolio contains. For example, a 50:50 stock-to-bond ratio has 50% stock and 50% bonds.

Dynamic Allocation incrementally overweights stock during a bear market in order to take advantage of a lower market as a buying opportunity. This incremental shift is shown in the far left-hand side of the diagram below. During the market downturn, the stock-to-bond ratio is incrementally increased from 40:60 to 70:30 reflecting an increase in stock investments. Then during a bull market, the stock-to-bond ratio is incrementally and gradually shifted away from stocks (middle part of the diagram) and more to bonds in order to lock in the gains and prepare for the next downturn. The process is repeated for every bull-bear cycle.